Indian Bank Personal Loan

Are you planning to take a world tour but falling short of money? Finance your world trip instantly with Indian Bank Personal Loan, and that too at affordable interest rates. Indian Bank offers multi-purpose loan to help you meet your unplanned as well as planned expenditure. It also offers personalized loan solutions to cater the varying requirements of the borrowers.

Headquartered in Chennai, Indian Bank has its branches in different states of India as well as in different parts of the world. It is amongst one of the top-performing banks in public sector in India. Indian Bank Personal Loan is available in high quantum as well as available easily in just a few clicks.

WHY SHOULD I APPLY FOR INDIAN BANK PERSONAL LOAN?

Indian Bank provides quite a wide range of loan services to its customers and keeps on coming with discounted loan schemes for borrowers. There are multiple reasons which make Indian Bank Personal Loan one of the best options for you, some of the reasons are listed below:-

- It offers the personal loan at low interest rates

- Attractive loan offers for special borrowers

- Loan available in huge quantum

- Affordable and low Processing fee

- It provides flexible loan tenure up to 60 months.

- Part-payment and pre-closure option at almost zero charges

- Top-up loan option also available

- Instant application procedure

- Quick availability of loan

Indian Bank Personal Loan Interest Rate

FEATURES OF INDIAN BANK PERSONAL LOAN

Indian Bank Personal Loan is an affordable loan option for the borrowers. The interest rates are quite low as well as there are almost zero hidden charges, so you need not worry about any extra expenses. The major features and benefits associated with the Indian Bank Personal Loan are listed below:-

Low interest rates

The rate of interest charged by Indian Bank on the personal loans is quite low in comparison to other banks and financial institutes. The interest rate starts from 9% which is only provided by only a few banks.

Instant loan up to 6 lac

You can instantly meet your bulk requirement of cash as the loan up to 6 lac is easily and instantly available with the Indian Bank.

Easy Online loan application

You can easily apply for the Indian Bank Personal Loan online. You just need to fill up a loan application form which requires some basic personal information about you.

Quick Disbursal of funds

The funds are instantly transferred to your bank account after the approval of your loan application. You receive the funds in just a few days, so the Indian Bank.

Instant Top-up loan

The top-up loan facility allows you to get an additional loan amount. In case, you fall short of funds, then you need not apply for a new loan as this facility helps you get some additional funds instantly.

Flexible repayment tenure

You can easily decide the repayment tenure on basis of your income as you can extend the loan tenure up to 60 months.

Low loan processing fee

Indian Bank charges very low loan processing charges which helps you to get a loan without making any sort of additional expenses.

Easy pre-closure and part payment option

You can easily pay-off your loan in accordance with the availability of the cash. The pre-closure and part-payment option are available with almost no or very minimal charges.

Easy documentation

The documents required for the approval of Indian Bank Personal Loan quite a basic one. The best part is the documentation process is also conducted online which makes the entire process paperless.

Indian Bank Personal Loan Fees & Charges

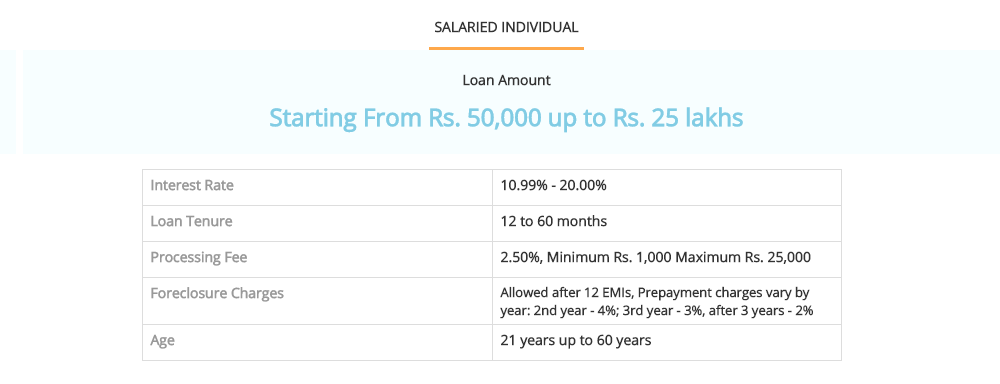

| Loan Processing Fees | Up to 2.50% of loan amount, Rs 1,000 to 25,000 |

|---|---|

| Pre-payment Charges | 4% of principal outstanding - 13 to 24 months, 3% of principal outstanding – 25 to 36 months 2% of principal outstanding - >36 months |

| Penalty for late EMI payment | 24% per year on outstanding amount From default date |

CHECK YOUR ELIGIBILITY FOR INDIAN BANK PERSONAL LOAN

If you are planning to take a personal loan from Indian Bank, then at first, you need to check your eligibility for the loan. The eligibility criteria are described below in detail; take a look:-

- Your minimum age should be 21 years and the maximum age should be 58 years (at the time of maturity of loan).

- If you are a salaried employee, then you should have the work experience of 2 years. If you are self-employed professional, then you should be in the same business for 2 years.

- You should be a self-employed professional or a salaried employee with regular monthly income.

- Your monthly income should meet the minimum income requirement.

- The applicant should be an Indian citizen

- 18 years or above people are eligible.

- In case the candidate is a minor, the parents or legal guardian of the minor can start the account on behalf of the applicant.

- The candidate is expected to have valid identity and address proof that is government sanctioned.

DOCUMENTS REQUIRED

Individual signature card rendered by the bank

Passport size photographs

Copy of PAN card

The text of address proof (Driving license, passport, Voter ID card, etc..)

Copy of identity proof(PAN card, driving license, Voter card, passport, etc.,)

Form 16 (only if PAN card is not available)

Confirmation address Passport

Utility bill (telephone, electricity, water, gas) – less than two months old

Letter from a known public authority (gazetted officer) verifying the customer’s home address

Bank Passbook or Bank account statement

WHY TO APPLY FOR INDIAN PERSONAL LOANS AT RUPEE STATION?

Low-interest rate

The applicants who are querying for the loan have the privilege where the bank grants with low-interest charges on loan supplied to them.

No unknown charges

Rupee Station knows that the users have a tough time making money; therefore Rupee Station presents with no additional or hidden fees when the user applies for the loan.

Disbursal of funds within two days

We know that value of money that is needed to the applicant hence at Rupee Station the user can get the funds within two working days after the documents are verified and approved by the bank.

Secure documentation

Paperwork can be a pain sometimes. If the applicants have the option to dodge paperwork, then they would happily do it. Therefore, Rupee station doesn't believe in extensive documentation and hence tries to make the work easy for the applicants.

Credit score

If the applicant is seeking for a loan and the cibil score is nowhere near the expected number, then they need not worry. Candidates with low credit score can get loans at Rupee Station.

STEPS INVOLVED IN PERSONAL LOAN AT RUPEE STATION?

Step 1

The applicant first needs to fill a form. This can be done manually by marching down to the bank, or they can fill the online application form.

Step 2

The application form which is submitted is first viewed and after an application form is considered it is then approved. The bank announces the decision within few minutes

Step 3

The applicant form after getting accepted is then processed, and the money is transferred to the applicant within two working days.