Axis Bank Personal Loan

Axis Bank is considered as one of the largest private banks in India. The bank grants its users with corporate investment, lending, financing, and treasury duties. It also offers to lend the SMEs, agriculture loans and micro-financing assistance. It proposes a wide range of loan products to satisfy every person's demands and conditions. Personal Loans are one such demand offered by Axis Bank to meet the expenses of people like taking a holiday or clearing off for a child’s education, wedding in the family, etc. Axis Bank Personal Loan is available at the lowest interest rates providing Personal Loans from Rs 50 thousand to Rs 15 lakh. It advances with a straightforward procedure, minimum documentation and immediate approval of loans.

WHY TO OPT FOR PERSONAL LOAN AT AXIS BANK?

- Low interest rates

- High Loan tenure

- Flexibility in repayment

- Minimum paperwork

- Easy documentation

- Instant approval

- 24/7 customer service

- Remarkable customer service

Axis Bank Personal Loan Interest Rate

WHAT ARE THE FEATURES OF AXIS BANK PERSONAL LOAN?

- Loans are available at the range of Rs.50, 000 to Rs.15 lakh.

- Loans are assigned to salaried people. Therefore, candidates who are employed and draw a salary of Rs 15,000 and above can avail the loan.

- The payment tenure granted for the installment of the loan is 12 months to 60 months. Thus, the applicant availing the Axis Bank Personal loan can select any tenure for payment. The loan should be repaid within the maximum allowable tenure of 5 years.

- Axis Bank provides with an affordable interest rate.

- The bank grants Balance Transfer Facility to consumers, permitting them to shift their current Personal Loans from different or another bank to Axis Bank.

- The whole loan procedure is quick and straightforward. The procedure is analyzed so that a layperson can also learn how to apply and avail a loan quickly. The documentation is minimum, and the approval is fast and simple so that the applicant does not have to pause for the approval.

- The applicant can also make part pre-payments against his or her loan account, and there are no charges for the same

Axis Bank Personal Loan Fees & Charges

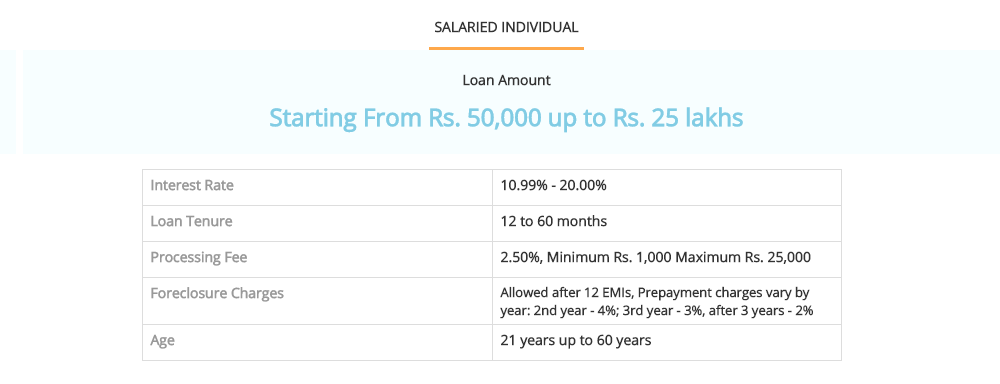

| Loan Processing Fees | Up to 2.50% of loan amount, Rs 1,000 to 25,000 |

|---|---|

| Pre-payment Charges | 4% of principal outstanding - 13 to 24 months, 3% of principal outstanding – 25 to 36 months 2% of principal outstanding - >36 months |

| Penalty for late EMI payment | 24% per year on outstanding amount From default date |

WHO ALL ARE ELIGIBLE FOR PERSONAL LOAN AT AXIS BANK?

The applicants who are working employees be it a usual employee or a professional worker, both can appeal for the Personal Loan.

The candidate should be within 21-60 years of age. Therefore, anyone that is aged 21 years and over can quickly avail the loan if he or she meets the other mandated standard. Though the higher limit is 60 years, and for candidates aged 60 or over, loans are not provided as per the bank’s loan system.

Any candidate who wants money up to Rs.15 lakh can avail the loan from the bank. The credit cannot be availed greater than 15 lakh as it is the highest capped limit of the bank.

DOCUMENTATION NEEDED FOR PERSONAL LOAN AT AXIS BANK

Income reports and salary slips

Bank reports and latest income-tax revenues

Credit record

Address proof (Adhaar, passport, electricity bill, telephone bill, ration card, etc.)

Age proof (birth certificate, passport, Adhaar, voter id, PAN card, etc.)

Picture identification proof (Adhaar, voter id, PAN card, passport, driving license, etc.)

WHY CHOOSE AXIS BANK PERSONAL LOANS AT RUPEE STATION?

No hidden charges

Rupee Station understands that the users have tough time making money; therefore Rupee Station provides with no additional or hidden charges when the user applies for the loan.

Economic interest rate

The applicants who are seeking for the loan have the privilege where the bank provides with low interest charges on loan supplied to them.

Easy documentation

Paperwork can be a pain sometimes. If the applicants have the option to dodge paperwork, then they would happily do it. Therefore, Rupee station doesn't believe in extensive documentation and hence tries to make the work easy for the applicants.

Disbursal of funds within two days

We understand that importance of funds needed to the applicant hence at Rupee Station the user can get the funds within two working days after the documents are verified and approved by the bank

Credit score

If the applicant is seeking for a loan and the cibil score is nowhere near the expected number, then they need not worry. Candidates with low credit score can get loans at Rupee Station.

HOW TO APPLY FOR A LOAN IN AXIS BANK AT RUPEE STATION ONLINE?

The resulting instructions can meet online credits for the individual seeking Personal Loans. The applicant can opt for a Personal loan by the following steps:

Step 1

To get a loan from a trusted lender, verify that you have all the relevant information and fill it accordingly for a Personal loan.

Step 2

Rupee Station will send the application to Axis Bank, who would offer the applicant with the loan amount. Read the terms and conditions thoroughly to accept the terms and conditions

Step 3

The approved loan is ready to be sent.