Allahabad Bank Personal Loan

Are you in need of instant funds? If yes, then opt for Allahabad Bank personal loan which is instantly available in a short span of just a few days. In order to make the personal loan available at affordable rates, Allahabad Bank offers different loan schemes to different borrowers. To meet the varying requirement of borrowers, Allahabad Bank provides multiple types of loans which will easily match your requirement.

You can easily and instantly apply for Allahabad Bank personal loan at Rupee Station which is a one-stop platform for all types of loans. We at Rupee Station, help borrowers to get funds instantly with minimal documentation procedure. So, with Rupee Station you can easily meet your instant funds requirements in just a few mouse clicks.

Why to opt for Allahabad Personal Loan?

Allahabad Bank offers its customers various exciting schemes and offers to make personal loan an affordable option for everyone. These schemes help customers select the loan which fits their budget as well as meet their pocket. Below listed are some of the benefits of taking Allahabad Bank personal loan, have a look –

- Loan available for salaried and self-employed individuals

- Floating rate of interest

- Low processing charges

- Easy Documentation

- Special schemes

- Instant fund available

- Top-up loan option also available

- Flexible tenure of repayment extending up to 60 months

- Pre-closure and part-payment option available

Allahabad Bank Interest Rate for Personal Loan

Why Choose Allahabad Bank personal loan?

Allahabad Bank offers numerous benefits to its borrowers and helps them to experience a hassle free-loan procedure. Below listed are the key-features of Allahabad Bank personal loan, know in detail

Loan available for salaried and self-employed individuals

Allahabad Bank offers personal loan to salaried employees as well as to the self-employed professionals. So, no matter in which category you fall, you can easily get the personal loan.

Floating rate of interest

The rate of interest charged by the bank on the personal loan is floating so if during the tenure of your loan the rate of interest falls, you will pay according to the decreased rate only.

Low processing charges

The loan processing fee charged by the bank is very minimal and so you need not pay heavy amount for the getting your loan approved.

Easy Documentation

Personal loan documentation process for Allahabad Bank is very easy as they only require few of the basic documents which are mostly available.

Special schemes

Customized interest rates and schemes are offered by Allahabad Bank for the borrowers falling in the special category. These offers and interest rates make Allahabad Bank personal loan an affordable option.

Instant fund available

Funds are instantly available in just a short span of two days after the approval of your loan application. So, you need not wait for the weeks and months to get the amount in your bank.

Top-up loan option also available

Allahabad Bank also provides you the facility of top-up loan options so even after taking the loan you fall short of funds, you easily get some more funds within no time.

Flexible tenure of repayment up to 60 months

The repayment tenure of the loan is quite flexible. You can repay the loan in small EMI depending upon the flow of your income extending up to 60 months.

Pre-closure and part-payment option available

You can also repay your loan even before the due dates via pre-closure and part-payment option. So, in case you want to repay your loan even before its completion, you can easily do the same.

Allahabad Bank Personal Loan Fees & Charges

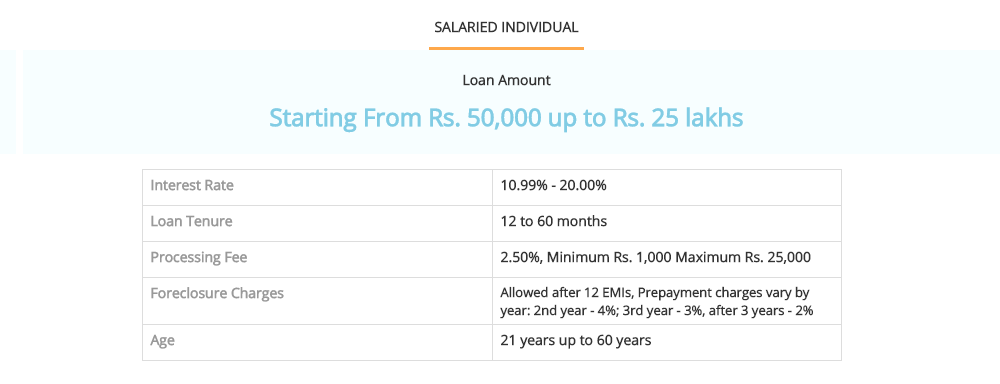

| Loan Processing Fees | Up to 2.50% of loan amount, Rs 1,000 to 25,000 |

|---|---|

| Pre-payment Charges | 4% of principal outstanding - 13 to 24 months, 3% of principal outstanding – 25 to 36 months 2% of principal outstanding - >36 months |

| Penalty for late EMI payment | 24% per year on outstanding amount From default date |

Allahabad Bank Eligibility Criteria for Personal loan

The eligibility criteria to apply for the Allahabad Bank personal loan is quite a basic one, so anyone can easily apply for the loan. Here are the eligibility criteria for Allahabad Bank personal, have a look

You should be a citizen of India falling in the age group 21 to 58 years old.

Your monthly income should be more than minimum monthly income required by the bank which is currently around 20000

You should be a permanent employee who has served more than two years in his/her current organization.

Essential Documents for Allahabad Bank Personal Loan

With Rupee Station, the documentation procedure goes very easy as you only need to provide few of the basic documents. The documents required for Allahabad bank personal loan are listed below, have a look

Loan Application

Duly filled loan application is required to be submitted by the candidate.

KYC Documents

Voter ID/ Driving License/ PAN

Income Proof

Statement of Bank for past 6 months/ ITR or form 16

Residence Proof

Passport/Electricity Bill/Telephone Bill

Photo

One passport size photograph

Reasons to apply for Allahabad Bank personal loan

If you have a bad credit score and unable to get loan from other financial institutions or bank, then Rupee Station is the best platform for you. At Rupee Station, we also provide loan to people with bad credit history. In addition, we provide personal loan at the lowest rate of interest. Below listed are few of the major benefits of applying for personal loan at Rupee Station, have a look

Instant loan application

At Rupee Station, you can easily apply for Allahabad Bank personal loan as you only need to fill a loan application form. Just fill in the basic information asked and you are done with the process of applying personal loan.

Quick loan approval process

Rupee Station shares an exclusive collaboration with Allahabad Bank so the loan application is processed instantly leading to quick approval of your loan.

Funds available in just 2 days

Once your loan application is approved, funds are made available to you in just a short span of two days. So, with Rupee Station, you need not to wait much for getting the loan amount in hand.

Customer support services

You might face some issue while applying for the loan at Rupee Station or might have some doubts regarding the process so; we offer you instant support with our customer support services.

Personalized loan offers

The loan requirement varies widely from person to person so in order to meet such a varying demand we provide our customers with personalized loan offers.

Process to apply for loan at Rupee Station

At Rupee Station, you can easily apply for the loan in just 3 simple steps. Let’s have a look at the process of applying for personal loan at Rupee Station -

Step 1

Provide your basic information by filling an online loan application.

Step 2

Our financial experts will call you to get other required information.

Step 3

Get funds in just two days after the approval of your loan application.

Allahabad Bank Personal Loan Interest Rates

The interest rate charged on personal loan by Allahabad bank starts just from 11.60% and goes up to 13.60% which is quite low in comparison to other banks. So, if you are planning to apply for a personal loan then Allahabad Bank is one of the best options for you.

Allahabad Bank Free Personal Loan EMI Calculator

The repayment of the loan amount seems to be a great challenge to the borrowers, thus the bank allows the repayment of the entire amount in small monthly installments. If you want to calculate the EMI through EMI Calculator and know your expected minimum monthly installment even before applying for the loan.

Allahabad Bank Personal Loan Eligibility Criteria

Eligibility criteria to apply for the personal loan at Allahabad bank are quite basic such as you should be the citizen of India, your age should be between 21 to 65 years, and you should have a regular monthly income more than the minimum monthly requirement of the bank. Almost everyone easily meets these criteria and applies for the loan instantly.

How to Apply for Allahabad Bank Personal Loan Online with Low-Interest Rates?

If you are searching for the personal loan at Allahabad Bank with the lowest rate of interest then apply at Rupee Station. We have exclusively collaborated with the bank to provide our customers with the best offers and low rates. In addition, we also compare the multiple loan schemes to provide you the one which perfectly suits your requirement.

What Documents Required for Allahabad Personal Loan?

You only need some of the basic documents to apply for Allahabad Bank Loan such as your KYC documents, income proof, and statement of the bank and so on. These documents are easily available with almost every individual and we accept the soft copy of the documents which makes the documentation procedure hassle-free and paperless.